Life Insurance in and around Tulsa

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

It may make you uncomfortable to entertain ideas about when you pass away, but preparing for that day with life insurance is one of the most significant ways you can demonstrate love to your family.

State Farm can help insure you and your loved ones

Now is a good time to think about Life insurance

Put Those Worries To Rest

Death may be part of life but that doesn’t make it easy. With life insurance from State Farm, loss can be a bit less debilitating. Life insurance provides financial support when it’s needed most. Coverage from State Farm gives time to recover without worrying about expenses like utility bills, college tuition or home repair costs. You can work with State Farm Agent Austin Jones to demonstrate love for your family with a policy that meets your specific situation and needs. With life insurance from State Farm, you and your loved ones will be cared for every step of the way.

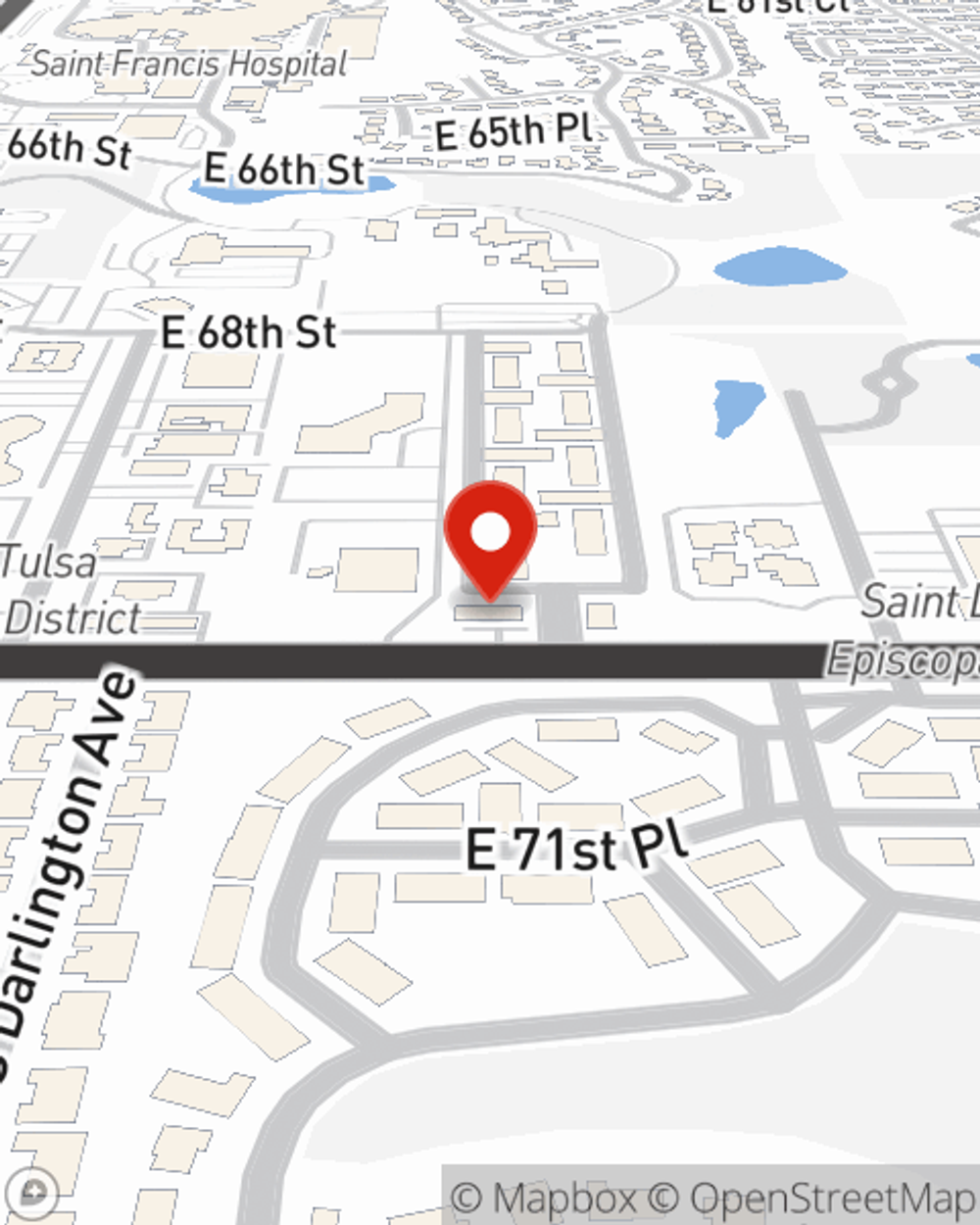

If you're looking for reliable coverage and compassionate service, you're in the right place. Call or email State Farm agent Austin Jones now to discover which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Austin at (918) 940-2840 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Austin Jones

State Farm® Insurance AgentSimple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.